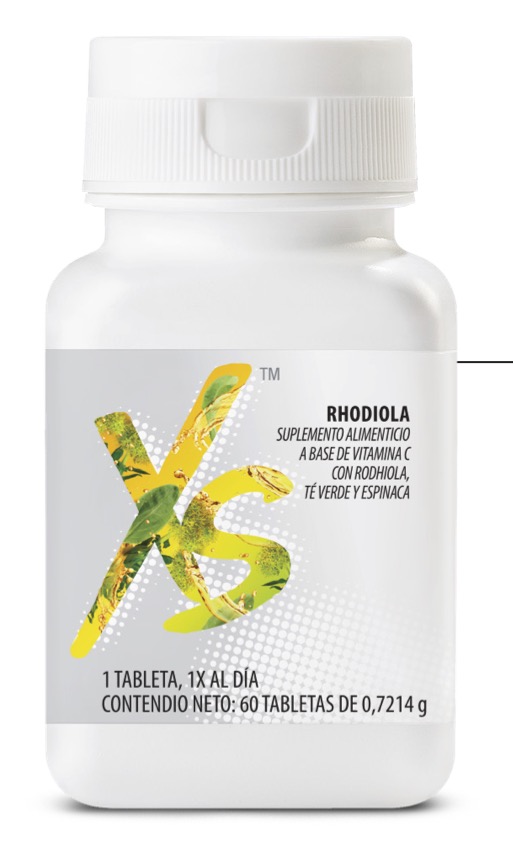

XS Rhodiola | Nueva imagen, misma fórmula. Ideal para deportistas. #ViveXS | By Nutrilite Latinoamérica | Facebook

AristoCaps RB 30 Cápsulas de Rhodiola Rosea y Complejo B. Medicamento Herbolario. : Amazon.com.mx: Salud y Cuidado Personal

Amazon.com: Rhodiola Rosea Suplemento Extracto de Alta Potencia 500 mg - 3% Rosavins 1% Salidrosides con Ashwagandha Shisandra Passion Flower Hierb Powder Cápsulas - Forma Natural de Aliviar el Estrés - Píldoras